Table Of Content

Other benefits include a cap on closing costs (which may be paid by the seller), no broker fees, and no MIP. VA loans require a “funding fee,” a percentage of the loan amount that helps offset the cost to taxpayers. The funding fee varies depending on your military service category and loan amount.

How To Qualify for a $700K Home

We do not include the universe of companies or financial offers that may be available to you. You may be able to buy a house with no down payment if you qualify for a down payment assistance program. These are often city- or state-based, and they usually provide no more than the bare minimum you need to qualify for a loan, such as 3%. The Community Seconds and Affordable Seconds programs are two ways to buy a home with 0% down. The average down payment on a home is 12%, according to the National Association of Realtors. Fortunately, with the wide range of home loans available in today’s market, it’s possible to buy a home with as little as 3% down.

Minimum down payment requirements

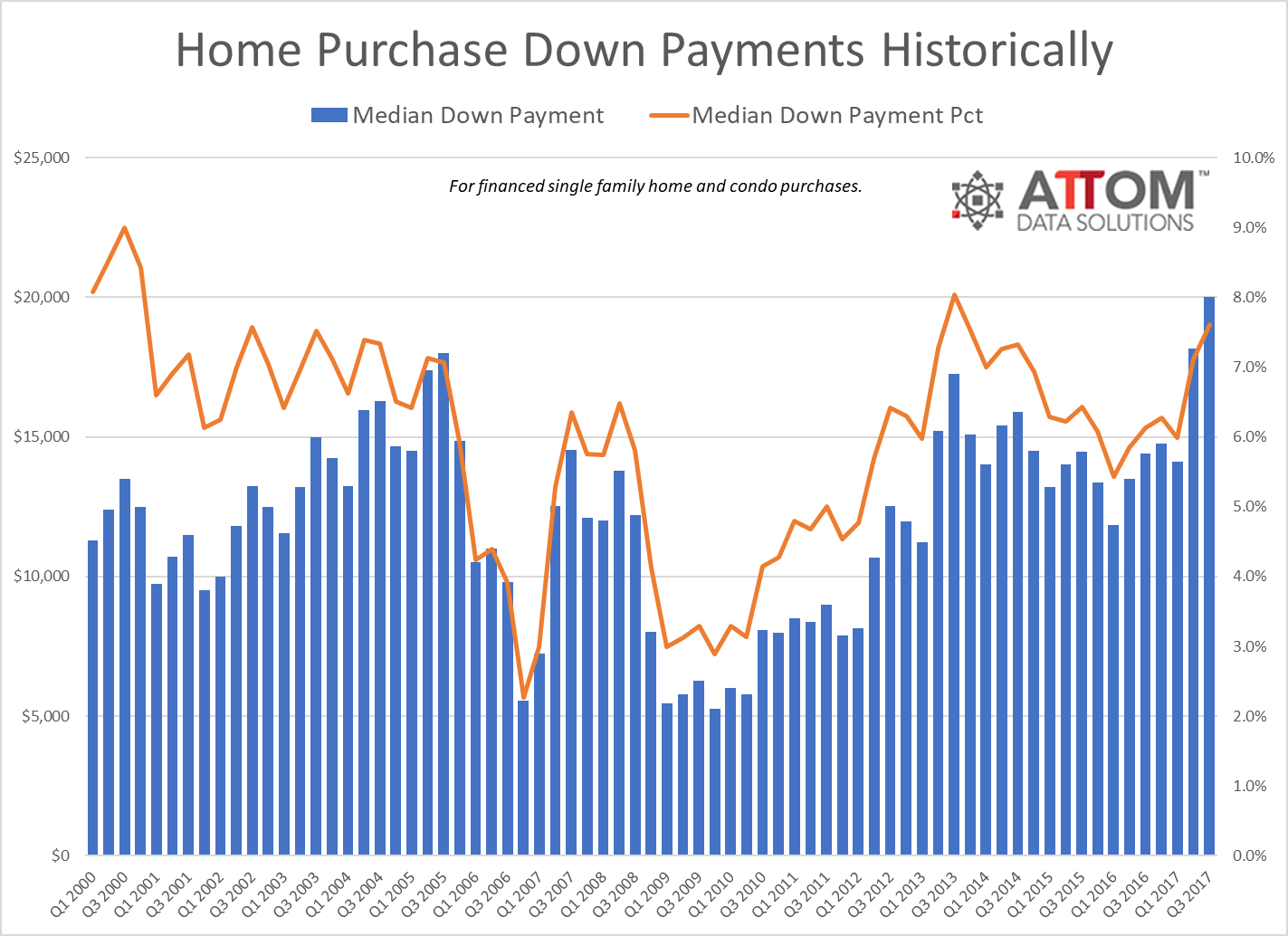

A smaller down payment will get you into your home quicker and leave you more money to cover repairs and insurance and to invest in other financial goals. By 2005, the median down payment was only 13%, according to a Washington Post analysis of National Association of Realtors data. The information herein is general and educational in nature and should not be considered legal or tax advice.

Down Payments for Second Homes Are Higher

Down payment assistance programs are usually limited to first-time homebuyers or low-income homebuyers; the definition of low-income will reflect local housing prices. For conventional and Federal Housing Administration (FHA) loans, the size of your down payment determines how much you’ll pay for mortgage insurance. Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts.

Minnesota rain totals: Wet weather continues to start week

A conventional, fixed-rate home mortgage loan is accessible with a down payment as low as 3% – 5% for certain homebuyers. The amount of your down payment also affects how much money you borrow to fund the total cost of a house. Plus, with a lower mortgage amount, you’ll pay back less interest over the life of the loan. Use the calculator below to test different down payment amounts and see how they would change the estimated mortgage payment.

How much do you need for a down payment on a home? - Business Insider

How much do you need for a down payment on a home?.

Posted: Tue, 28 Nov 2023 08:00:00 GMT [source]

Even a .25% reduction in your interest rate could save you thousands of dollars over the life of your loan. In some cases, you don’t have to pay for your whole down payment by yourself. These funds are offered through state or local governments, as well as nonprofit organizations. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site.

If you have excellent credit with a 20% down payment, a conventional loan may be a great option, as it usually offers lower interest rates without private mortgage insurance (PMI). You can still obtain a conventional loan with less than a 20% down payment, but PMI will be required. For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes. If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf.

Online & mobile banking

When saving for a house, you may not think about factoring in home maintenance. Keeping up with pipes that leak and appliances that break can be tough, especially if you don’t buy a brand-new home. According to Thumbtack, the average annual cost of home maintenance on a single-family home is $555 a month.

Jumbo loan: 10 percent down payment

PMI is a type of mortgage insurance that conventional loan lenders often require for their own protection in the unfortunate event that a borrower ends up defaulting on their home loan. Most lenders require that you pay for PMI if you bring a down payment of less than 20% to the closing table. U.S. military service personnel, veterans, and their families can qualify for zero-down loans backed by the U.S.

Borrowed Funds – You can use borrowed funds for your downpayment if the minimum downpayment is funded through a traditional source first. This source can come from lines of credit, credit cards, personal loans, or loans from a family member. However, the borrowed funds amount must be included in your total debt service (TDS) ratio calculation. Consider talking to a loan officer about the types of mortgage loans available to you based on your current credit score, income and other factors to determine the size of down payment you’ll need. Your lender may require that you get mortgage loan insurance, even if you have a 20% down payment. That’s usually the case if you’re self-employed or have a poor credit history.

Once you’ve saved your down payment and decided which mortgage loan best suits your needs, you’re ready for action. Start your mortgage application with a Home Loan Expert at Rocket Mortgage. VA loans and USDA loans can have a zero-down payment, but you must meet the minimum qualifications set by both programs. Home sellers often prefer to work with buyers who make at least a 20% down payment. A bigger down payment is a strong signal that your finances are in order, so you may have an easier time getting a mortgage.

A maximum charge of £145 will apply on imports of plant and animal products, such as cheese and fish, entering the UK through the Port of Dover and Eurotunnel from Tuesday. This falls under the Consumer Rights Act 2015 which states that any faults found within the first six months are considered to have been there at the point of purchase (or in this case, application). A demand for smaller homes has driven growth in UK property prices early in 2024, according to research by Halifax. Work and Pensions Secretary Mel Stride is set to announce plans today to overhaul the way disability benefits work. We also want to know how you give them the money (cash, bank transfer, app) - and if they have to do anything in return. How much you'll be able to get from an item often takes into account its rarity, condition, whether it reflects a period in time, and if it's got a good name behind it.

If you're a first-time homebuyer with an FHA loan and a 3% down requirement, you would need $15,000. PMI can be a helpful tool to make homeownership a reality for anyone who might struggle to save a 20% down payment. But it is a monthly cost in addition to your mortgage, and unlike your mortgage payments, PMI payments will not help you build equity in your home. The size of your down payment depends on your savings, income, and budget for a new home. The amount you designate as a down payment helps a lender determine the loan amount for which you qualify and the type of mortgage that meets your needs.

Additionally, having a good credit score of 670 or above helps you qualify for lower rates and fees, as lenders perceive less risk. If you’re living in a high-cost metro area, you may need a jumbo loan to afford a home. The down payment requirements for jumbo loans vary by lender and range from 10% to 30%, with 20% being the most common threshold. In the second quarter of 2023, Louisiana home buyers made the lowest average down payment of 9.2% at $6,729, while Washington, D.C.

No comments:

Post a Comment